refund for unemployment taxes paid in 2020

Revised 2020 Unemployment Compensation Worksheet. Will I receive a 10200 refund.

Irs To Send 4 Million Additional Tax Refunds For Unemployment

If you received unemployment you may find the exclusion will reduce your taxable income and may provide you with an increased refund.

. Why is my tax refund so low in 2020 there may be different causes for 2019 returns filed in. This page contains guidance and information regarding the treatment of unemployment compensation when filing an Indiana 2020 individual income tax return and was most recently updated on June 16 2021. These benefits are mostly funded by taxes that are paid by employers at the federal and state levels.

Updated March 23 2022 A1. You cant deduct any of the taxes paid in 2021 because they relate to the 2020 property tax year and you didnt own the home until 2021. What are the unemployment tax refunds.

The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. You agreed to pay all taxes due after the date of sale.

Under state law the taxes become a lien on May 31. The total amount of income you. Salaries and bank interest For tax year 2020 the first 10200 of unemployment income were tax free for taxpayers with an AGI of less than 150000.

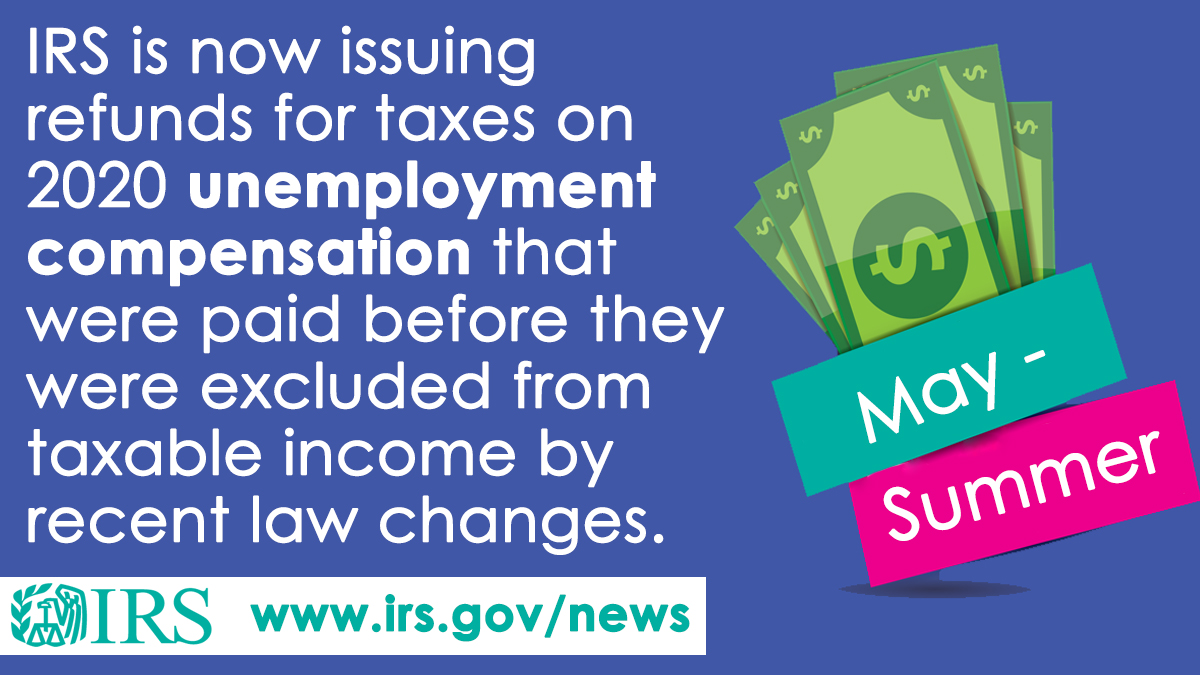

Maximum Refund Guarantee Maximum Tax Savings. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The new American Rescue Plan Act provides an exclusion of 10200 for unemployment income received in 2020.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. The taxes due in 2021 for 2020 were 1375. Click the infographic to the right to see full size image.

The taxes due in 2022 for 2021 will be 1425.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff